How to Check Employee Provident Fund PF status by using UAN Number or PF Account Number or Aadhaar Number (EPF Claim Status) at www.epfindia.com or www.epfindia.gov.in….

This is a retirement benefit provided to the employees who worked on the salary basis. This fund is maintained and regulated by the Employees Provident Fund Organization of India (EPFO). In case of company with over 20 employees is required by law to register with EPFO. Employees’ Provident fund Organization of India (EPFO) provides two official websites www.epfindia.com or www.epfindia.gov.in by which an employee can easily check his / her EPF claim status by using PF Account Number or Aadhaar Number or Employee Provident Fund PF Claim Status Check by using UAN Number. Before checking the PF status it is necessary to have the followings:-

EPF claim status by using UAN Number or PF Account Number or PF Claim Status Check by using Aadhaar Number

Dude’s here is the very simple steps to know your Provident Fund EPF Status Check by using UAN Number or Aadhar Number. Procedure are as follows….

- Go to the searching tab of your browser and entered http://www.epfindia.gov.in/site_en/KYCS.php or http://www.epfindia.com/site_en/KYCS.php. It will bring you to the official web sites where you can check your PF claim status by using PF Account Number.

- After open that interface, There will be an option to choose your state where your PF office is. For example ODISHA, DELHI.

- After selecting the state, Various regional office of relevant state will be shown. Click on the regional office where you belong to.

- On choosing of the region office, the region code and office code will fill-up automatically in the respective boxes.

- Entered the Establishment code of PF Account Number in the third box (maximum 7 digits).

- If Establishment code has an extension code or a sub-code, enter the same in the fourth box. It will be in a format of a digit or letter as the case may be and can be of maximum 3 characters in size. If there is no extension code or sub code to Establishment code, leave that field blank.

- On this page you have to enter Your EPF account number in the fifth box which also can be of maximum 7 digits.

- Click on Submit button to get your EPF status.

Everybody easily track the EPF claim status.

- Through UAN Member Portal

- EPF website

- By adding the PF account number

- By calling EPFO calling number

- Umang APP

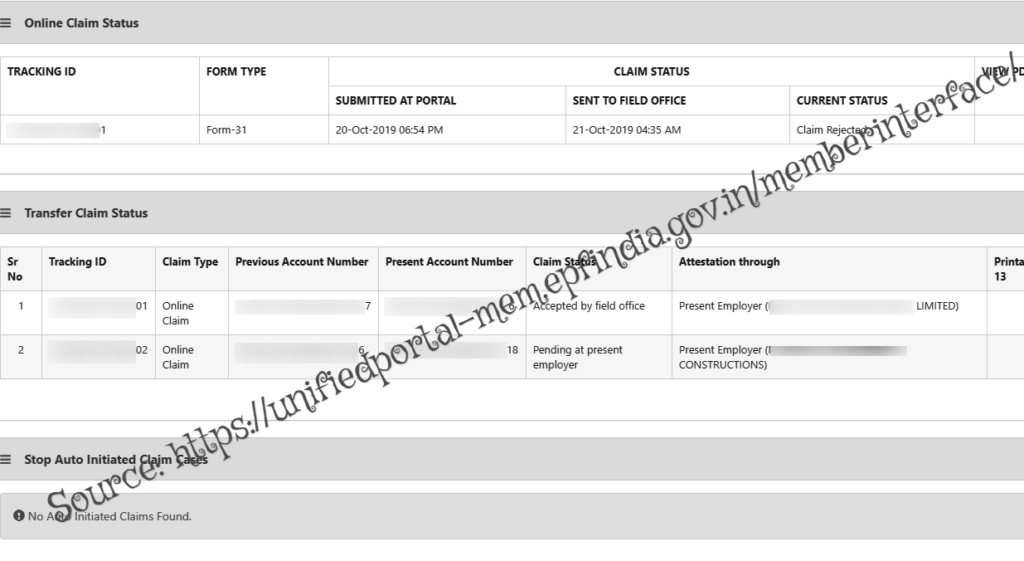

- Then tap on the “Track Claim Status

- The status of the online claim will appear

What is UAN (Unique / universal account number)?

Every person who has a provident fund account is allotted a unique account number by the EPFO. UAN allows to access, check and withdraw from your provident fund account without any interference from your account.

Direct link to PF Claim Status Check at https://passbook.epfindia.gov.in/MemClaimStatusUAN/

Important Notice

- Link your Aadhaar Card with your UAN.

- Do not share your EPF account number and password.

- Employees’ Provident fund (EPF) account number.

- EPF regional office of your employer.

- Company code or extension code (if required).