Detailed process on PF Balance Check without UAN Number or EPF Balance without UAN or PF Balance without Aadhaar Number at passbook.epfindia.gov.in website….

What is Provident Fund? The savings can be used by the EPF for a wide variety of investments, and the participating employees are repaid through reinvested dividends. Employees may withdraw 30% of their accumulated EPF savings at age 50 and over 54 can withdraw up to 90 percent of the accumulated balance with epf interest rates while it can withdraw 100% at age 55. Actually it is very easy to search the EPF Balance Check or PF Balance check without UAN Number or Aadhaar Number.

The Universal Account Number helps the EPFO in tracking the change in the new job of the employee. When the employee are going to changing to a new job then his new Provident Fund Account will be connected to the UAN. The EPFO will update the same its record. UAN facilities help in online making withdrawals. It also helps to transferring your pf amount very secure when you change your job. It makes sure that your PF account is genuine.

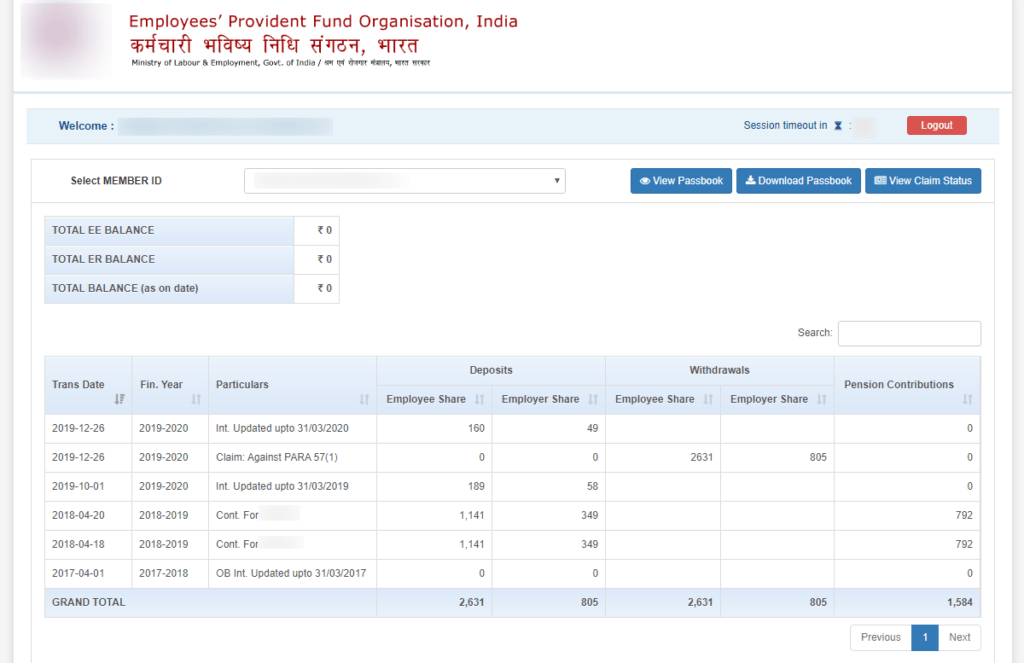

How to check PF Balance Check without UAN number or EPF Balance without UAN number or Aadhaar Number at www.epfindia.gov.in

The most common way of checking your Employees Provident Fund status is normally through UAN number in their portal. This is the method that has been used by many people and all they need to do is visit the Universal Account Number’s portal, fill in the necessary details and they will get all the information needed. The challenge with this however, is that you cannot be able to use this format if you have not activated your Universal Account Number.

Here we are giving you some simple steps following which you can find out your PF balance check without UAN number or PF Balance without Aadhaar Number –

- First, open the EPFO official website with the URL: https://www.epfindia.gov.in or https://unifiedportal-mem.epfindia.gov.in/ or passbook.epfindia.gov.in

- Click the link “Know your EPF Balance.”

- Choose the state of your belonging from where you can choose your EPFO Office and then click on the link your Office.

- Enter your Employee PF Account Number, Name and Mobile Number which is mandatory.

- Then, click on the ‘Submit’ button by which you will be able to see your Employee PF Balance.

Employees who don’t have or don’t know their UAN number can also check their PF balance without uan on the portal. To find out the process read the below steps.

1. By Sending SMS:

- To avail the service of SMS, your UAN must be registered with EPFO. This SMS service helps you to find out the PF balance without using your UAN number.

- You just need to send an on the number 7738299899.

- In the message box type EPFPHO UAN ENG and click on Send button.

- This will provide you with a message displaying your PF balance in English.

- This facility is also available in Kannada, Hindi, Malayalam, Bengali, Gujarati, and many more. So any user can get the message of their PF balance in their desired language. In the place ENG you need to enter the first three letters of your language.

2. By Giving a Missed Call:

You can also get the details of your PF balance by giving a missed call on the number 011-229014016 from your registered mobile number in UAN portal. For this process, you don’t need to know your UAN number. However, you need to be registered on the UAN portal and provide the KYC details.

3. ON UMANG APP:

This is one of the easy ways to know your PF balance check without uan number. Visit the Google PlayStore and search for UMANG app. This app is an initiative of Government of India under the Digital India Program. You can avail all the government services under the common platform and that is UMANG app. Download the app and install it.

- After installing the app select the EPFO option from the homepage.

- Choose the Employee centric services option and enter your EPF universal account number.

- You will be able to login using an OTP which will be sent to your registered mobile number.

- From here, you can choose the PF balance check option that is present under the services tab.

Also, if an employer has its salary of Rs.6500/- then it would have to contribute 1.16% up to the actual wage. In this amount there will be employer’s share in the Pension Scheme will be around Rs.541. There are various types of Provident Fund which are given below –

Public Provident Fund (PPF):-

Public Provident Fund (PPF) is one of the popular long-term investment options which is supported by Government of India. Public-Private Fund (PPF) sometimes is also referred as Public-Private Investment Fund (PPIF). It offers security with attractive interest rate and returns that are fully exempted from Tax. Here, Investors can invest minimum Rs. 500 to maximum Rs. 1,50,000 in a particular financial year and then can get the facilities such as loan, withdrawal, and extension of account as well. Opening Public-Private Fund is very easy and hassle-free as well. For the PPF Account, you must have to attain the maturity of at-least 15 years.

Statutory Provident Fund (SPF / GPF):-

Statutory Provident Fund (SPF) can be referred to Government Provident Fund (GPF) as well. These funds usually are applicable to government bodies and universities. So employees who work for these institutions would be eligible to subscribe to them. For the GPF it must have to attain the maturity at superannuation.